Market Outlook for 2024

Financial Advice

14-12-2023

Market Outlook for 2024

SHARE

Mission Accomplished – Is Inflation Defeated?

Key observations:

Economic scenarios for 2024

Central Banks have all but declared ‘mission accomplished’ in the battle against inflation. Policy cash rates are likely to have peaked with the Fed and RBA signaling cash rates are sufficient to continue the decline of inflation. The threshold for rate hikes appears higher given many areas of the economy are cooling.

Markets are pricing in a ‘goldilocks’ scenario of rising growth and declining inflation, but we think the economic outlook is more uncertain as economic indicators point to slowing growth and monetary conditions remain tight. For now, there is continued signs of resilience in economies, particularly in the US, though China’s economy remains a concern.

Australia is behind the US economic cycle with inflation coming down later than the US, and more local factors at play. Australia has to navigate some disadvantages compared to the US including our predominantly floating rate and short dated fixed rate mortgages. We also have higher debt loads and less affordable housing prices.

Market scenarios for 2024

Markets have assessed incoming economic data, a resilient consumer, and productivity as supportive of equities, while bond yields have come down as inflation concerns are declining. Interest rate markets are pricing no hikes by the RBA and Federal Reserve with some cuts implied from mid-2024.

Equity and credit markets wobbled in late September. We expect seasonality will help drive a rally into year end and January although we remain cautious of market weakness over the next year, even if its modest. In 2024 the key for successful investing is to be flexible in navigating between scenarios of no recession, soft landing and deep recession. We expect markets to rotate between pricing these scenarios this year.

We believe risks are more balanced looking forward into 2024 with scenarios for both bullishness and bearishness. The worst of the post Covid era extremes are dampening down to more moderate business cycle oscillations. We would also caution against central banks announcing ‘mission accomplished’ too early on the inflation front. This is as strong secular trends are in place for the next decade that mean inflation emerges episodically. Therefore, portfolio construction will require more thoughtfulness for the next year and decade.

US election years are seasonally strong for equity markets as stimulus is injected by government authorities..

Longer term themes for the next few years

- Geopolitical volatility is the new ‘normal’ and has to be factored into investment analysis.

- Climate change imposes costs and creates opportunities.

- Debt limitations funding growth.

- Technology convergence and acceleration where we see crossovers from AI, blockchain, hyperscale data.

- Social disruption and challenge to traditional institutions from Neil Howe’s Fourth Turning.

- Interactions between popular themes and narratives create waves of cheap vs expensive thematic investing opportunities.

- Very long-term cycles are relevant given the learnings of Neil Howe’s Fourth Turning, where 20-25 year eras roll into a four generation cycle. These become predictable with 700 years of historical analysis.

Anecdotes that intersect long term with right now

- A 70-year drought restricts Panama canal traffic and pushes up freight rates and delays shipping.

- New asset classes challenge as AI, blockchain, big tech and cybersecurity stocks rally.

- President Xi’s meeting with President Biden in California deflates some geopolitical risks but raises others.

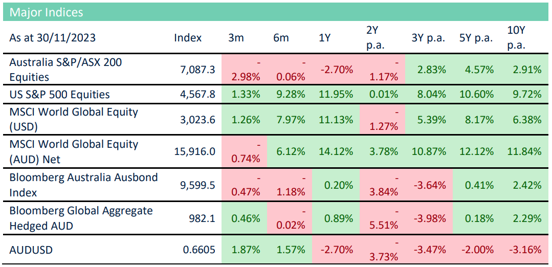

Quarterly Market Performance (to 30 November 2023)

- Equity markets rose over the quarter in most markets.

- Ten-year government bonds peaked at over 5% in Australia and the US then fell in dramatically yield.

- Credit spreads fell to lows for the year prompted by cash rates peaking and soft-landing expectations.

- Currencies initially saw the USD stronger for the quarter, with the opposite trends for AUD, JPY and EUR.

- Commodities were mixed, with lower oil prices and rising markets in agriculture, gold and industrial metals.

- Volatility for the US Equity VIX and currency vol neared lows, while bond and gold volatility were elevated.

Market Performance

Economies

Australia’s GDP rose by 2.1% for the year and 0.2% for the quarter to September, as the annual pace was nearly steady and the quarterly pace growing. Inflation was 5.4% for the year to September, slowing from 6.0% in the year to last quarter, while the quarterly rate of inflation picked up from 0.8% to 1.2%. Unemployment rose slightly to 3.67% from 3.60% in September, not far above the decade low of 3.47% to December 2022. Forward looking indicators appear to be both low and weakening further, with the Purchasing Manager Indices (PMI) in Australia are weakening to annual lows across manufacturing, services and construction with business confidence at the low end and consumer confidence extremely weak.

The impact of high interest rates and high-cost pressures are continuing to weigh on the Australian economy with the RBA appearing to be on hold as high interest rates slow activity in the economy and the pace of inflation. ANZ job ads are weakening, implying unemployment is likely to rise. Australia appears to be suffering from lagged effects of rate hikes with GDP flat, and unemployment up despite inflation coming down. The prospect for further weakening of the economy is highlighted by downward trends in PMIs and job ads while the RBA maintains high interest rates.

The United States’ GDP rose by 1.3% (5.2% annualized) for the quarter and 3.0% for the year to September, both up strongly over the quarter from the prior period. Headline Inflation declined to 3.2% in September, down from 3.7% the prior two months and in line with 3.2% in July. The move up in inflation for three months appears temporary with the trend resuming its downward pace since peaking at 9.1% in September 2022. Unemployment was up to 3.7% in September from the 3.50% low two quarters ago. Forward looking indicators from the PMI indices for manufacturing are rising erratically from a trough, while services are improving and expansionary. Small business optimism weakened over the quarter to October, while consumer confidence was weaker over the quarter. US growth is surprisingly strong while inflation is falling, a ‘goldilocks’ period of recovery, which seems at odds with a modest rise in unemployment. Policy settings of interest rates and government spending will be key with both weighing against the recovery at present.

The Eurozone GDP weakened, declining -0.1% for the quarter to September from +0.1% in the prior quarter, while the annual GDP continued to decline at 0.0% for the year to September, down from a 0.6% annual pace to June. Inflation continued slowing at a 2.4% annual pace to November, down from 5.2% in August, continuing the downtrend since the peak of 10.6% in October 2022. Unemployment remained at a multi-year low of 6.5% which it has remained for 7 of the last 8 months. Forward looking indicators from the EU PMI indices are rising from lows. Consumer confidence has improved over the last year and month to November despite some temporary weakness in the last quarter. Confidence in business sectors is mixed with manufacturing trending down, services sideways and construction improving over the quarter and year to November. Europe may be turning the corner while GDP remains low but inflation declines and unemployment remains low. Sentiment measures while mixed are showing improvement with consumers and construction.

China’s official GDP rose 1.3% for the quarter and 4.9% for the year to September, stronger for the quarter but weaker for the year. Inflation remains weak at -0.2% for the year to October, slipping into negative territory again after recovering from a -0.3% low yearly pace in July. Unemployment was at 5.0% in October, down from 5.3% a quarter ago. Forward looking indicators for manufacturing and services indicated volatile but neutral manufacturing and weakening services over the year to November. Consumer confidence remains near lows for the year while improving over the quarter to October. Overall, China’s economy is struggling as muted stimulus efforts aren’t having much effect.

Economic outlook

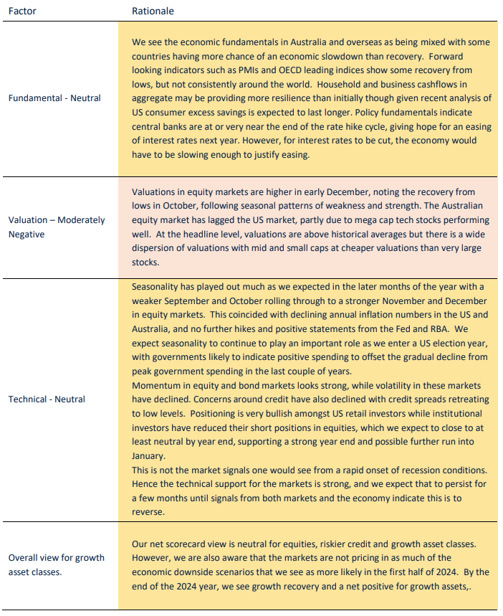

The overall economic outlook is mixed with relative strength in the US, a weak China and Europe troughing and Australia vulnerable to contraction. Interest rate and government spending policy will be key to the year ahead as policy makers struggle with the challenges of a typically seasonally strong US election year and many other elections around the world in 2024. There are pockets of strength from forward looking indicators, and what seems to be a final peak in interest rates in major economies, unless we have major changes to policy, optimism builds from confidence survey lows and the ‘soft landing’ narrative takes hold. US and Australian central bank policy is priced for cuts by markets in mid-2024, however for that to happen, policy makers will need to see reason to cut, that is a more visible economic downturn and especially a trend higher in unemployment. Therefore a ‘soft landing’ of no significant contraction appears at odds with markets. We see a base case of a modest economic contraction which continues from weakening geographies and sectors as lagged effects of higher interest rates continues to be felt. Risks to this view are for no contraction which would be bullish for equity markets and negative for bond prices, while a deeper downturn or recession would be negative for equities and positive for bond prices. We believe that there is a wider mix of outcomes with the probabilities weighted more to the downside.

On the positive side, we still believe that many multi-year trends will be supportive of future growth. These include the role of technology in many forms alongside the significant investment and construction for energy, critical materials, manufacturing, and supply chain transitions. Support for renewal will also be required from recent wars. The size of these transitions ensures a positive tailwind for the next few decades offering new jobs and engagement for many people around the world. A challenge will be the financing and debt for these new investments where debt loads are already high. Additional complications arise where geopolitical issues and generational upheaval makes navigation of the pathway to growth more challenging.

Asset Class Performance and Outlook

Australian Equities

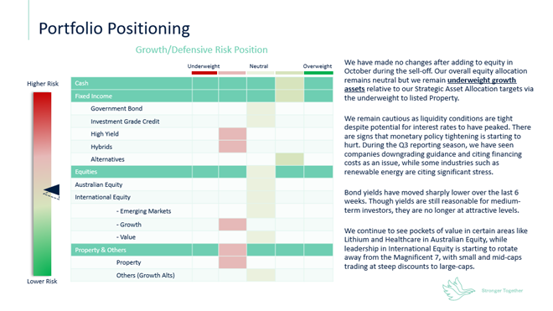

We believe there are risks to Australian Equities from very lagged effects from tighter monetary policy on businesses and consumers, and growing pressures on bank credit provision. However, there is some resilience from higher overall cash positions that albeit facing drawdowns, are higher in some parts of society and strained in others. The migration impact is being strongly debated against housing supply with migration losing out with stricter limits to inflows to apply from next year. We see that small and mid-caps have good valuations.

International Equities

International equities whipsawed as the sharp correction in October reversed in November. The ‘Magnificent Seven’ have performed strongly for the year, creating a large rift with the rest of equity market. More broadly, large caps outperformed small caps and the US outperformed the rest of the world. The spreads in valuations between large caps and small caps, and US with the rest of the world, have now become significant. The quality factor has also significantly outperformed for the year though this moderated in the recent quarter. This divergence could represent a long-term opportunity for the patient investor however, we expect this will likely require a catalyst of improving economic growth, especially in terms of the differential between the US and the rest of the world, or easier monetary conditions.

Fixed Income

Bond markets had dramatic swings over the quarter with a surge in Australian and US 10-year bond yields to just over 5% before reversing and falling by 0.70-0.85% to the low 4% yield levels by early December. These moves are not surprising given uncertainty about where the Fed and RBA would end up, and if higher inflation numbers would force further hikes. As inflation numbers continued to fall and statements from the Fed and RBA all but concluded that rate hikes were over, money market futures priced in more cuts and removed hikes from futures markets for next year. While bond index returns had some negative returns through to October on rising bond rates, these were being reversed as bond yields fell. We see risk being priced out of credit spreads as they fell to cycle lows. These are somewhat conflicting signals, in that lower bond yields and cuts imply an economic downturn while tighter credit spreads imply a supportive economic environment. We expect some more volatility in bonds as different economic cycles get priced in and out during the course of 2024.

Tactical Asset Allocation

Portfolio Positioning

This information is general in nature and is provided by Partners Wealth Group. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.