A 'comfortable’ retirement - how much is enough?

Financial Advice

14-12-2023

A 'comfortable’ retirement - how much is enough?

SHARE

A comfortable retirement is something that most of us aspire to, and with some careful planning, many will achieve. However, the notion of a ‘comfortable’ retirement is personal and means something different to everyone. There is no single dollar amount that applies to all - how much money or assets you need to live comfortably for the next 10, 20 or 30 plus years differs from person to person and can vary from year to year.

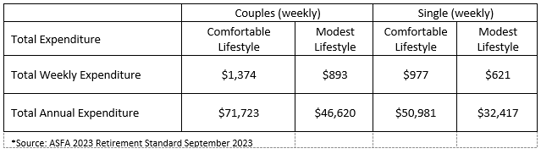

Generally speaking, there are guidelines that provide an estimate of how much money is needed to retire comfortably. The Association of Superannuation Funds of Australia (ASFA) estimates that Australians aged over 67 who own their own home outright and are in relatively good health, will need the following amount of money each week and year in retirement:

So based on these estimates, how much do you actually need to have in ‘retirement assets’ to:

a) generate a good income, and;

b) ensure the capital lasts throughout your retirement years.

For a ‘comfortable’ retirement, it is estimated that an individual will need between $700,000 - $900,000 (including $595,000 in superannuation and a couple will need $1m - $1.2m (including $690,000 in superannuation*) in today’s money.

This estimate excludes lifestyle assets (which are generally not investments or income deriving, such as the family home), but these would potentially be available for sale if required. It also assumes a life expectancy somewhere between 82 and 85 years of age.

To many people this may seem out of reach, but with strategic planning (and the power of investment and cumulative interest!) you would be surprised at how achievable a ‘comfortable retirement' could be.

There are several factors to consider when determining how much money you will need for retirement. For example:

- What age would you like to retire? The younger you are, the more money you will need.

- How long will you be retired? A difficult question to answer, but an important one!

- What are your retirement lifestyle expectations? Consider essential living expenses, clothing, hobbies/interests, holidays/travel, home maintenance, insurance etc.

- Will you need different amounts of income depending on your stage of retirement? Typically, as people age their spending habits change. Younger retirees spend more on leisure and travel pursuits, but at around the age of 75 this starts to shift and spending becomes more focused on assistive services and medical needs. Generally, people tend to spend less as they get older.

- Where will your retirement income come from? Superannuation? Age pension? Investments, savings, inheritance?

As every person’s retirement goals are unique, financial advisors spend a large amount of time understanding the long-term needs, goals and objectives of their clients - so that they can work out what a comfortable retirement looks like to them, what it will cost, and then devise a plan to get them there. Other factors such as personal risk profile, years until retirement, also have a big influence over the best financial strategy to reach the goal of a comfortable retirement. For example, it would be counterproductive to recommend that a client invest their funds into a high risk investment portfolio in order to fast track retirement savings, if their appetite for risk is low.

As you can see, planning for retirement is a personal journey and requires a tailored approach as every individual brings a unique set of circumstances, needs and aspirations. By regularly reviewing your financial position with your financial advisor you can feel confident that you are navigating your way towards a comfortable retirement while managing the financial ebbs and flows that life throws at you along the way.

This information is general in nature and is provided by Partners Wealth Group. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.